city of cincinnati tax payment

Collection Payments Pay By Mail. Essentially if you renovate or build a home in the City of Cincinnati you have the opportunity to pay less in taxes if you follow certain criteria.

How To Sell Your House With Liens Or Tax Problems In Cincinnati In 2021 Selling Your House Things To Sell Cash Buyers

513-352-2546 513-352-2542 fax taxwebmastercincinnati-ohgov.

. The due date for filing your annual Cincinnati Income Tax Return is April 15th or the 15th day of the fourth month following the end of each taxable year. Mail Collection payment to. Any resident engaged in a business such as owning rental property or a company must also file.

Nonresidents who work in Cincinnati also pay a local income tax of 210 the same as the local income tax paid by residents. While every effort is made to assure the data is accurate and current it must be accepted and used by the recipient with the understanding that no warranties expressed or implied concerning the accuracy reliability or suitability of this data have been. Pay by Credit Card.

Income Tax Office 805 Central Ave Suite 600 Cincinnati OH 45202. Mail all payment coupons to. Internal Revenue Service PO.

City of cincinnati income tax division 805 central avenue suite 600 cincinnati oh 45202-5799 7 6 5 4 3 2 1 fid if no account if required cincinnati acct taxpayer name ssnfid payment amt granted until date. The tax abatement allows residents and businesses to have a portion of their property taxes abated based on the improved value of their investment into a specific property. California Sales Tax By City 2021.

The Cincinnati Residential Tax Abatement program minimizes property owners taxes by allowing them to pay taxes on the pre-improvement value of their property for 10-15 years. Property tax abatement is available for any increased valuation that results from improvements to the property for new. The City of Cincinnatis Residential Property Tax Abatement allows owners to pay taxes on the pre-improvement value of their property for 10-15 years.

MILL -- A mill is 1 for each 1000 of assessed value. Residents of the City of Cincinnati may claim taxes paid to another city up to 21 of the Qualifying Wages reported on each individual W-2. Enter the amount of estimated tax payments including any amounts paid with an extension.

Emergency Mortgage Help Foreclosure Prevention. The goals of this program are. The application period is the first Monday in January through the first Monday in June of each year.

Property tax abatement is available for any increased valuation that results from improvements to the property for new construction and renovation. It could have been better. This site no longer offers Individual Efiling.

The account information contained within this web site is generated from computerized records maintained by the City of Cincinnati. Cincinnati Income Tax Division. Tax Payments The City of Sharonville Tax Office accepts payments in person and by mail to provide taxpayers with cost.

A person who does not live in Cincinnati but earned compensation within the city must also file a tax return. Median Property Taxes No Mortgage 2074. Cincinnati Property Tax Payments Annual Cincinnati Hamilton County.

Tax abatement benefits stay with the property the entire length of the abatement. Nonresidents who work in Cincinnati also pay a local income tax of 210 the same as the local income tax paid by residents. Refund requests must be made within three years from the date of your tax payment the date the tax.

This is the equivalent of 987week or 4277month. Median Property Taxes Mortgage 2497. How was your experience with papergov.

Tax rate for nonresidents who work in Cincinnati. Residents of Cincinnati pay a flat city income tax of 210 on earned income in addition to the Ohio income tax and the Federal income tax. Especially since many remote workers may never return to their downtown offices.

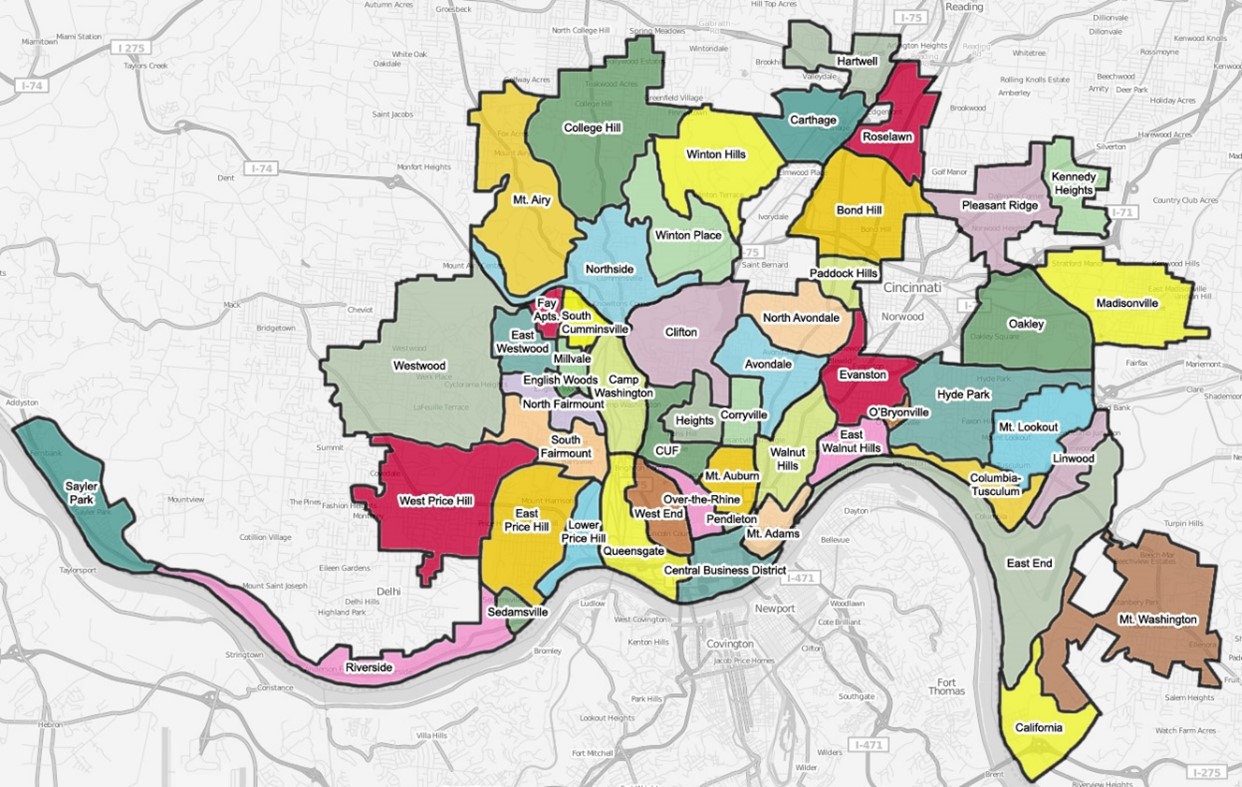

Resident Neighborhood Services. Learn about the services available to city residents in their neighborhoods. The City of Cincinnatis Residential Property Tax Abatement allows owners to pay taxes on the pre-improvement value of their property for 10-15 years.

Residents of Cincinnati pay a flat city income tax of 210 on earned income in addition to the Ohio income tax and the Federal income tax. E-File can also simplify the process of determining payments and credits made in the current tax year for clients with an active Cincinnati tax account. Offered by City of Cincinnati Ohio.

Credit is limited to the local tax rate used 21 or less multiplied by the. Law Department 801 Plum St Suite 214 Cincinnati OH 45202. Contact the City with questions.

To have tax forms mailed to you or with questions please call. Check Cashiers Check or Money Order payable to City of Cincinnati. When you build a new home or invest in renovations your property taxes can go up.

The City of Cincinnati has a 21 percent tax rate that is payable by residents who receive taxable income such as wages. Tax rates are computed in mills. Request for an extension of time to file your annual return must be submitted in writing prior to the due date of the tax return.

Property tax abatement is available for any increased valuation that results from improvements to the property for new construction and renovation.

Late For The Sky Cincinnati Opoly Game Walmart Com Board Games Gaming Gifts Bicycle Playing Cards

Cincinnati Map Antique Cincinnati City Map Print On Paper Or Etsy Cincinnati Map Map Print Map

My Building The Belmain Over The Rhine Cincinnati Cincinnati Center City

Free Image On Pixabay Buildings Bridge Illuminated New York City Vacation New York Vacation Solo Travel

Hudepohl Brewing Co Cincinnati Ohio Hudepohl Extra Pale Beer Label Irtp Ebay In 2022 Beer Label Brewing Co Beer

30 Most Endangered Buildings In The U S Cincinnati Museum Art Deco Buildings Cincinnati

Over The Rhine Tumblr Cool Kids Kids Street Style My Kind Of Town

Emergency Rental Assistance Gcww

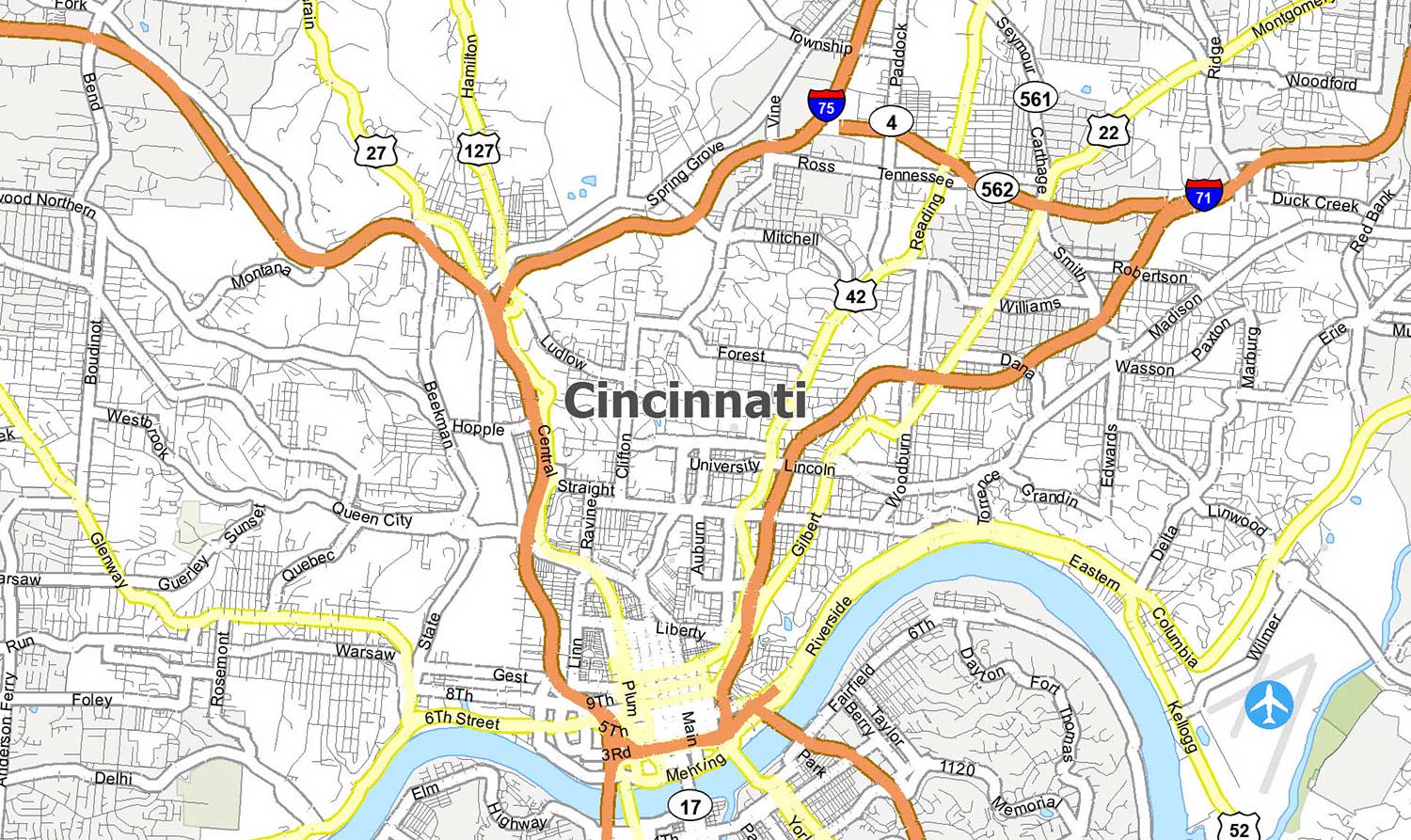

Map Of Cincinnati Ohio Gis Geography

621 Main St 3a Cincinnati City Oh 45202 Mls 1437393 Downtown Cincinnati Cincinnati Washington Hotel

Home For Sale Comey Shepherd 512 Baum St Cincinnati Oh Mls 1525938 Cincinnati Downtown Cincinnati Property Search

Pin On Queen City S Yesteryears

Cincinnati Ohio Community Wealth Org

15 W Fourth St 203 Cincinnati City Oh 45202 Mls 1432611 Traditional Building Green Energy Green Roof

Cincinnati Ohio In The Summer Cincinnati Ohio Cincinnati Ohio History

734 W Court St Cincinnati City Oh 45203 Mls 1403920 Cincinnati Downtown Cincinnati Ohio River